No cut but pressure is building

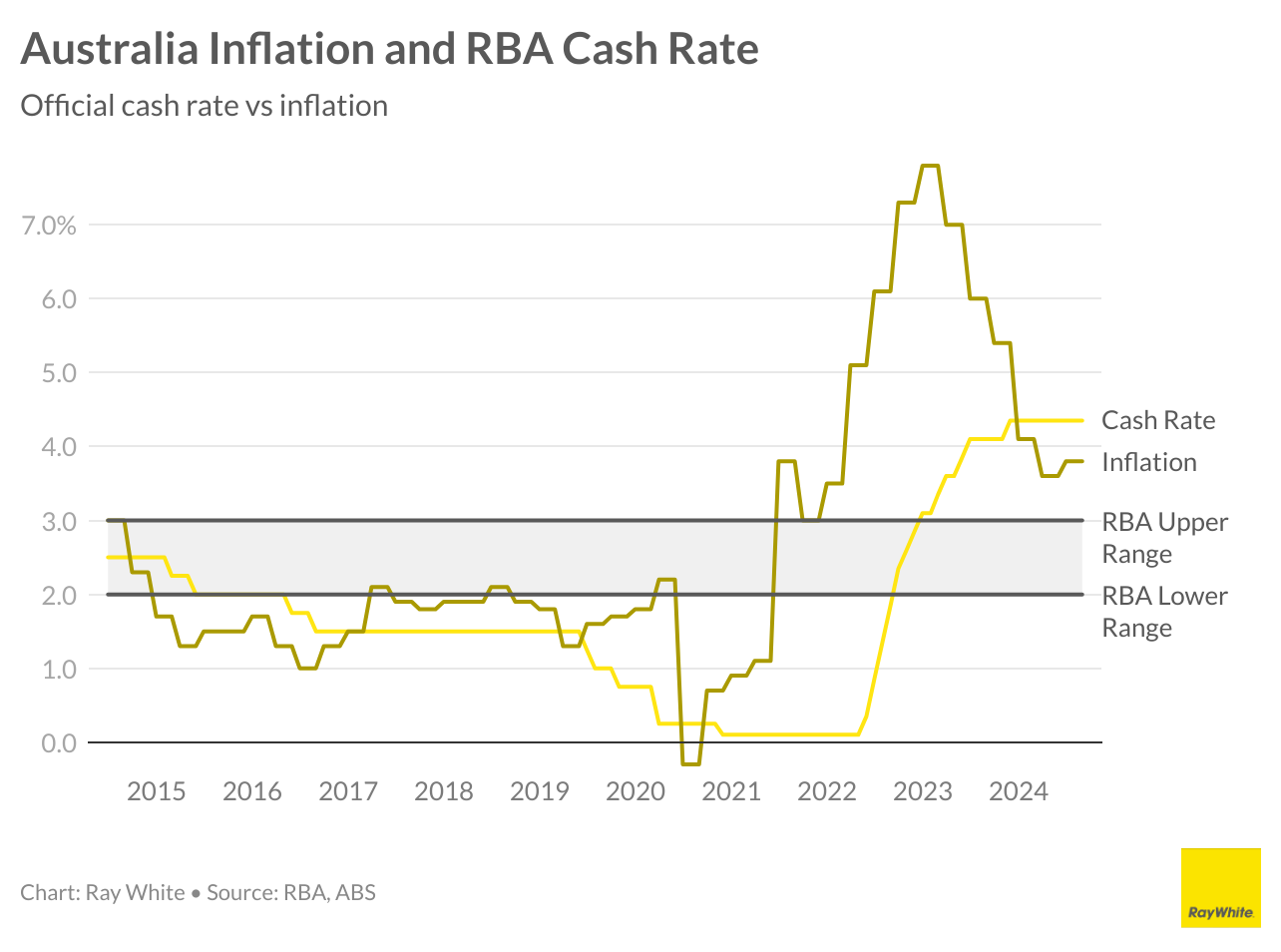

Australia hasn’t yet joined much of the rest of the world in cutting rates but pressure is building. Monthly inflation came in at 3.5 per cent in August, now just above the Reserve Bank of Australia’s upper limit of three per cent. It is now looking increasingly likely that we will hit three per cent by this year. A cut this year is now possible.

For now, the RBA has decided to hold. It is a difficult balancing act. Inflation is still a bit too high but we are now seeing signs of weakness in the economy. We are not in recession but have now seen three quarters of almost zero growth. Unemployment is creeping up and now sits at 4.2 per cent. Cost of living pressures have now led to record level participation rates.

Next year is looking far more positive for mortgage holders. Markets are currently pricing in four cuts for 2025 and another in early 2026. In response, mortgage providers are now cutting fixed rate home loans on average by 0.23 per cent. Not surprisingly, given the outlook for rate cuts, take up has been very low with consumers likely mindful of significant cuts to come.

Globally rates continue to fall. The European Union cut rates a second time two weeks ago and the US cut rates last week by 0.5 per cent. It is likely that a second round of cuts will continue to occur in many places that have cut already this year.

Article by:

Nerida Conisbee

Ray White Group

Chief Economist